AI is set to revolutionise how new pharmaceuticals are brought to market. So why aren’t the major pharmaceutical companies filing patents to AI-related inventions?

Investment in AI-related research and development has surged in recent years, and AI is increasingly seen as key to the future of innovation in the life sciences. Innovators are now applying AI methods to an enormous range of problems, from modelling biological systems and predicting the efficacy and safety of candidate drugs in early stage drug discovery to symptom evaluation, risk management and diagnostics.

Given the promise and potentially disruptive impacts of AI on the life sciences, it is no surprise that the list of pharmaceutical companies using AI continues to grow. The biggest players in the sector are seeking to unleash the power of AI to boost their pipelines, whether that is through developing AI expertise in house, partnering with companies specialising in AI, or through industry wide efforts such as Machine Learning Ledger Orchestration for Drug Discovery (MELLODDY), Machine Learning for Pharmaceutical Discovery and Synthesis Consortium (MLPDS) or the Alliance for Artificial Intelligence in Healthcare (AAIH).

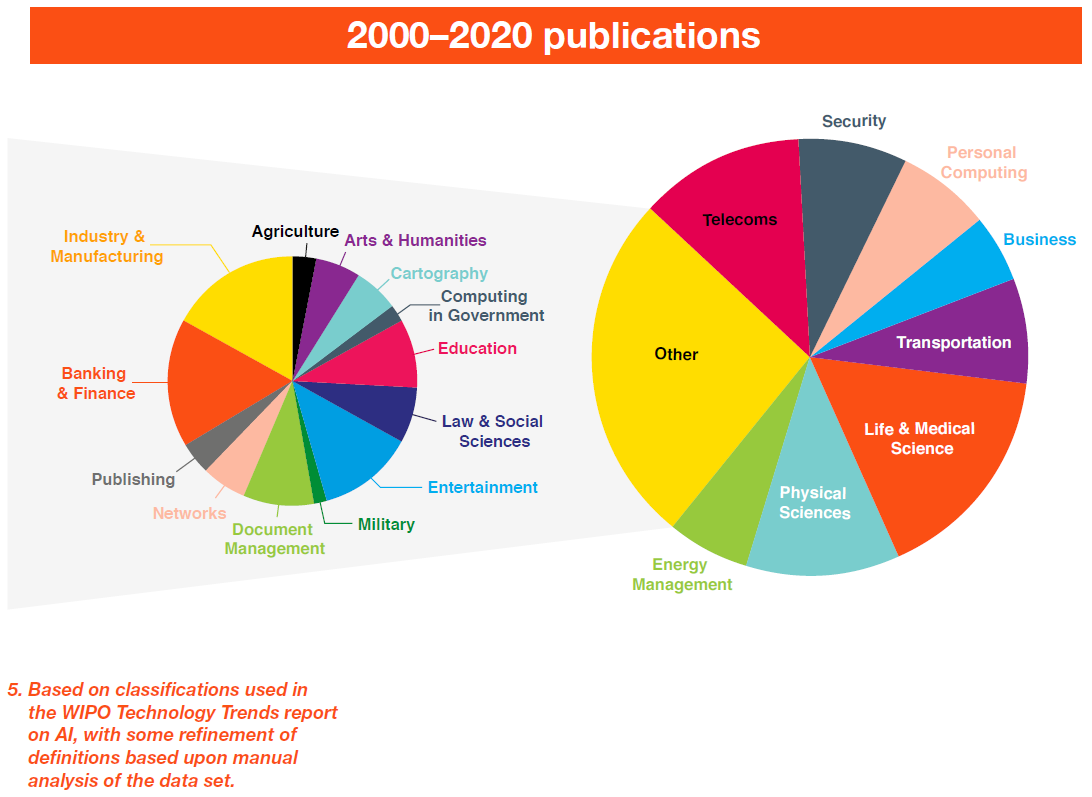

With all the interest in using AI in drug development, it is natural to expect a rush of related patent filings. Indeed, our analysis of patent filings shows that Life & Medical Science has the largest share of AI-related patent filings of any technology sector, accounting for 16% of European patent filings over the last 20 years (see here for full report AI patents at the EPO – a long-term trend analysis). Moreover, about 10% of the cases in the data classified as Life & Medical Sciences are classified as relating to traditional pharmaceutical preparations (i.e. they are classified under International Patent Classification code A61K). The interest in using AI to drive pharmaceutical innovation is clear. However, a closer look at who is filing these applications reveals that this high volume of patent filings is not bring driven by major pharmaceutical companies.

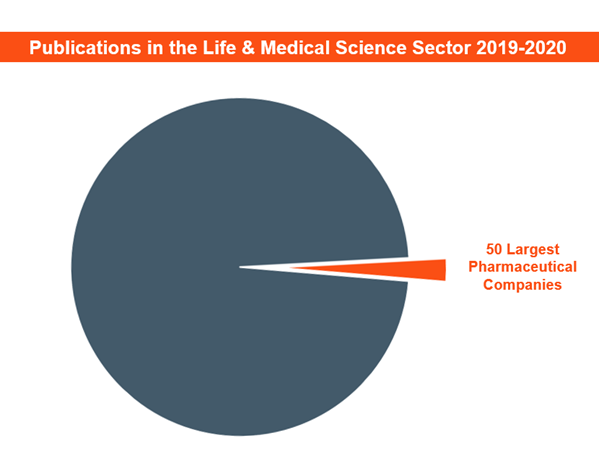

Our analysis of European patent filings allows us to see who has been filing AI-related applications in different sectors. Of the top 20 filers of AI-related applications in the Life & Medical Science sector in 2019 and 2020, only one major pharmaceutical company features. The list of top filers is dominated by tech firms – start-ups and established tech firms entering the life sciences space. What is more, barely more than 2% of the filings in the Life & Medical Science sectors were filed in the name of the most prominent pharmaceutical companies. Of the pharmaceutical companies that have filed any applications related to AI, the most prolific filer has filed 160 applications in the last 20 years, whereas the top AI filers have filed nearly 10 times that number. With all the efforts to bring AI into their businesses, one has to ask, why are pharmaceutical companies not filing more patent applications in the AI space?

One reasonable and likely explanation is that pharmaceutical companies are less interested in AI platforms and more interested in the products that they can help to develop. It is safe to expect that pharmaceutical companies will continue to be more interested in patenting the products that they bring to market rather than the techniques they use to develop the products.

Does this mean that pharmaceutical companies will increasingly rely on tech companies to develop the AI platforms, and then collaborate with or license technology from them? If so, as AI platforms continue to improve, making ever better predictions, there would seem to be a risk of traditional pharmaceutical players falling behind new entrants to the markets in the race to be at the forefront of drug development.

For these reasons it may be that pharmaceutical companies are developing advanced algorithms for assisting drug discovery, but keeping them as internal know-how or trade secrets, thereby avoiding the disclosure requirements of the patent system.

As useful as know-how and trade secrets can be, relying on them is not without its risks. They offer no protection from a competitor who independently invents the same technique – a significant risk in a rapidly evolving and competitive market. This is not to mention the lack of global harmonisation of laws protecting trade secrets and the complexities associated with protecting intellectual property rights after an unauthorised or accidental disclosure. An important point to bear in mind when considering the approach of pharmaceutical companies to AI is that, while advances in computer processing power and the mathematical techniques underpinning AI make previously intractable problems in the life sciences space seem solvable, the currency of AI powered research is data. Pharmaceutical companies have enormous reservoirs of valuable, proprietary data on candidate drugs and biological systems gathered over decades of real-world research. It is the combination of this data with powerful AI platforms that promises to unlock a new wave of innovation in the life sciences and, as pharmaceutical companies hold the lead in generating and maintaining this data, they already hold one of the keys.

Pharmaceutical companies may be comfortable with limiting their patent filings to AI technology while AI is establishing itself in the field, knowing that the data they hold is so important. But how might traditional pharmaceutical companies combine this data with AI technology to integrate AI into their business models? Collaboration between pharmaceutical companies and tech companies is already commonplace. The next step may be the acquisition of AI start-ups by major players in the pharmaceutical space. Whatever developments play out in the market, the dramatic rise in the number of AI patent filings means that we can be sure that patents will remain crucial in protecting the technology. Is it therefore only a matter of time before we see an increase in the number of AI patents filed by major life sciences companies?