The Barbie Movie has been a record breaker, becoming Warner Bros' highest-grossing film in the United States, and landing not one but three songs from the official soundtrack in the UK Charts’ top 5. In an age of social media, Barbie has become the ultimate influencer, the president of the ‘Barbiecore’ fashion movement, and the promoter of ‘Barbie pink’ home décor. Margot Robbie as Barbie embraced hair down summer vibes in the movie, leading to over 55 million social media interactions with the hashtag #barbiehair. But in recent weeks, Barbie has given rise to a more surprising and unexpected craze in the cosmetics industry - #barbieshoulders.

In an attempt to emulate Barbie’s aesthetic, Barbie fans have taken to injecting their shoulders with Botox® in an attempt to give the appearance of a longer, more slender neck. Botox® (also known as Botulinum toxin) has long been used to improve the appearance of facial wrinkles. By causing muscles as the site of injection to relax, those pesky crows feet around the eyes melt away (at least temporarily) giving the impression of eternal youth. However, by preventing the muscles at the site of injection from contracting and being exercised as they would be under normal conditions, Botox® use can lead to deterioration of the muscle tissue at the injection site, referred to as muscle atrophy. This generally undesirable side effect is now being exploited to achieve what is being referred to as ‘Barbie shoulders’ to induce muscle degeneration around the neck thereby visually elongating the neck. The procedure is also referred to as ‘Traptox’ in reference to the muscle injected, the trapezius, and was popularised earlier in 2023 by celebrity personality Kim Kardashian.

Whilst Botox® has been marketed since the early 1990s for wrinkle treatment, recent years have seen a boom in the cosmetics industry, and high streets have been transformed by aesthetic clinics offering Botox® services requiring minimally invasive procedures that do not require the presence of a skilled medical practitioner. It is estimated that the US Botox® market was worth in the region of $6 billion in 2021, over $7 billion in 2022, and is predicted to exceed $10 billion by the end of the decade. In the UK alone, it is estimated there are nearly 1 million Botox® injections annually. Shakespeare wrote “With mirth and laughter let old wrinkles come”, but it seems the world clearly disagrees with the bard and times have moved on.

Botox® is marketed by Allergan, and given the sheer market size, it is perhaps unsurprising that new formulations are the subject of several patent applications. Using a patent database (Derwent Innovation), our research suggests that over the last 10 years, Allergan / Abbvie have filed in excess of 70 different patent families relating to Botox® and uses thereof (where each patent family comprises at least one patent application filed in three major territories with significant cosmetic markets: China, US and Europe). This snap-shot of the patent protection around Botox® demonstrates how commercially important this product is.

Indeed, in recent years, attention has turned to developing alternatives to Botox® with increased longevity, reducing the need for frequent injections. One alternative, Daxibotulinum toxin A (also referred to as DAXI or DAXXIFY®), marketed by Revance, was approved by the FDA in 2022 for glabellar line treatment. Daxibotulinum toxin A comprises botulinum toxin, and a modified proprietary stabilising peptide (see pending European Patent Application No. EP3720475). Reports suggest that DAXIFFY® is effective for between six to nine months, compared to Botox® which is effective for three to four months, representing a possible route to a biannual wrinkle treatment.

Given the market dominance of Botox® over several decades, new alternatives such as DAXIFFY® represent a significant challenge to Boxox®’s market share, particularly in view of the claim that DAXIFFY® requires less frequent administration. In response, AbbVie have filed several law suits against Revance in the US including an alleged procurement of trade secrets by enticing away former Allergan employees and an alleged infringement of five patents relating to Botox®. The outcome of these legal proceedings will no doubt be eagerly awaited.

Aside from particular aesthetic goals, the ‘Barbie shoulders’ procedure using Botox® has also been used clinically to alleviate back pain. Similarly, DAXXIFY® was recently approved for treatment of Cervical Dystonia. It is therefore apparent that whilst the objective of many users of cosmetic products such as Botox® is purely aesthetic in nature, in many circumstances the cosmetic products also achieve some therapeutic effect too.

In certain countries, the overlap between cosmetic effects and therapeutic effects gives rise to challenges in obtaining patent protection, which European patent practitioners will be all too familiar with. Under the European Patent Convention, patents cannot be granted for methods of treatment of the human or animal body by surgery or therapy. China applies similar standards to the EPO, whereas in contrast, in other jurisdictions such as the USA, methods of treatment may be patentable. The skilled patent practitioner is therefore faced with the challenge of obtaining the broadest scope of protection for an inventor’s cosmetic technology, whilst avoiding falling foul of exclusions to patentability enforced in certain countries and achieving the broadest possible scope of protection across the globe. If a patent application has not been prepared with due consideration of these territorial nuances, it may prove fatal to an applicant’s chance of successfully obtaining patent protection for cosmetic technologies in the UK and Europe for instance.

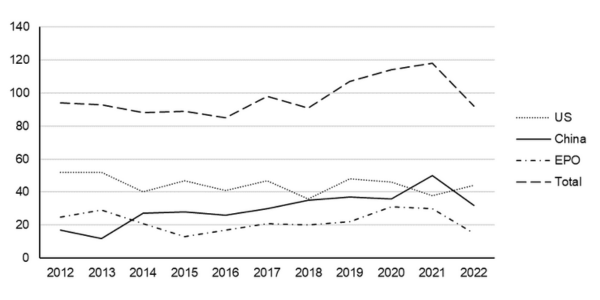

Considering the general patent landscape, our research suggests the number of patent applications that have published (in US, China and Europe) which relate to anti-wrinkle products and treatments, and which also describe Botox®, has steadily risen over the last 10 years. The steady increase in the number of patent applications again reflects the significant size of the cosmetics and anti-wrinkle market (see Figure 1 below). As shown in Figure 1 below, a significant amount of this growth has been driven by patent applications being filed in China, with the number of applications in the US and Europe remaining in a generally steady state. The data also suggests that the number of applications published decreased in 2022, perhaps reflecting a reduction in the overall number of patent applications filed in 2020 due to the COVID-19 pandemic. It will be interesting to see whether the overall number of applications published in this sector returns to pre-pandemic levels over the coming years.

Figure 1: Number of patent applications published by the European Patent Office (EPO), USPTO (US) and CNIPO (China) relating to anti-wrinkle treatments and devices that mention Botox®. The cumulative number of published patent applications over the indicated 10 year period is 1064.

If you are a technology company working in the cosmetics sector looking to build your IP portfolio, please do not hesitate to get in touch with one of our experts below who will be able to guide you through the process of obtaining patent protection for cosmetic technologies in Europe, the UK and worldwide.