For those who read my recent article which discussed the value of the aerospace sector to the UK economy, you will know that there are certainly green shoots of recovery in the sector after the trials of the pandemic.

As a follow-up to that, I was interested to see what sort of impact the pandemic had on innovation in the aerospace sector. To this end, we ran some searches on data for published patent applications in the aerospace sector (specifically, on aeroplanes and helicopters) to build a picture of innovation levels. As patent applications are filed by companies to protect new and useful technological developments, they can give us an idea of innovation levels and R&D efforts for a particular sector. The patent office where the application has been filed assigns the application a specific code according to its technical area, and we can use them to see how many patent applications have been published in that field.

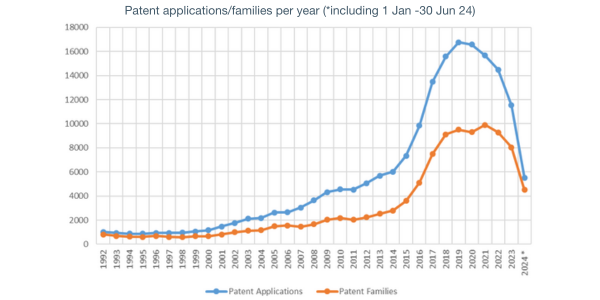

The results of our searches are shown in the graph below. The trend lines show raw number of patent applications (in blue) and number of patent families (in orange). Patents are territorial rights, and often a company will file several applications in different countries for the same invention. These can be grouped into patent families. So, looking at numbers of patent families (the orange line) can often give a better idea of innovation levels.

We can see that the numbers peaked in 2019 (blue) and 2021 (orange) and have been on a downward trend since then. At first sight, one could conclude that the pandemic has been the cause of these downward trends and numbers are yet to recover. Whilst that seems broadly correct, two things should be borne in mind about these numbers:

- For both curves there was a slight levelling off from 2018-2019, which seems to indicate the slowdown started pre-pandemic;

- We have only numbers for the first half of 2024.

On bullet point 2, if we extend the figures from the first half of 2024 over the full year, the numbers show levelling or even a slight increase over 2023. So, as with the numbers from my previous article, there do seem to be signs of recovery in innovation levels in the aerospace sector too, which is great to see.

What about carbon emissions?

One of the biggest focusses for companies in coming years is of course carbon emissions reduction, and much of this innovation will be geared towards that. In particular, the industry is wrestling with the challenge of how to achieve the ambitious net zero target on carbon emissions by 2050 set under the government’s Jet Zero Strategy. As one of the largest carbon emitting industries in the UK (international and domestic flights accounting for 8% of the country’s emissions in 2019) much needs to be done on reducing those emissions if we are to reach the target.

And much effort is being expended to try to reduce aerospace emissions, but it is proving a hard nut to crack. Road transport and rail lend themselves more easily to electrification than the aerospace industry, where weight and power density is so critical, particularly for medium and long-haul flights. Electrification of short-haul aviation is more viable, and recent reports suggest that investment into development of short-haul eVTOLs dwarfs investment into decarbonisation of other forms of aviation. (This is probably due to the greater viability of short-haul electrification but also because most users of eVTOLs will be private jet owners so there’s a big pool of money to invest.)

Sustainable aviation fuel (SAF) is having some impact on carbon emissions reduction but it is currently about 4 times as expensive as ordinary jet fuel, and at present it is difficult to see how that can change very much. Considering that fuel is by far an airline’s biggest cost, this is significant. Unfortunately, some commentators think there are no real alternatives to SAF till 2040 for medium and long-haul flights, and those flights produce 67% of the emissions.

Hydrogen and ammonia are seen by many to be a serious part of the solution. Hydrogen has had particular interest from UK companies, and now a UK-based company – Polar Technology – has achieved a class-leading solution for hydrogen storage that it claims will triple the range of unmanned air vehicles (UAVs). Hydrogen’s very low density and Houdini-like ability to escape from containers have proved especially challenging in reducing the hydrogen-based concepts to practice. The company will be showcasing at Farnborough its new storage solution which uses extremely thin wall liners to achieve 350bar pressure in the cylinder to give the UAV its huge range advantage. Whilst these cylinders are currently envisaged for small UAVs, if it can be scaled up to storage hydrogen for short- or even medium-haul aircraft it could make a real difference to their viability.

Compared to hydrogen, ammonia has the advantage of being liquid a room temperature giving it a much higher energy density than hydrogen. Ammonia is, however, a very corrosive material making it hard to handle safely.

There are clearly many different propulsion sources in the running, and for the foreseeable future it seems certain that no one source will dominate; the solution will need to be a blend of SAF, hydrogen, electrical and other forms of propulsion.

Conclusion

It is good to see signs of recovery of innovation levels in the sector after big drops over the pandemic, and I look forward to seeing that ingenuity employed to meet the mountainous net zero targets ahead.